The Beta of the stock/security is also used for measuring the systematic risks associated with the specific investment. Thus, as can be seen above, Security A has a lower beta therefore, it has a lower expected return while security B has a higher beta coefficient Beta Coefficient The beta coefficient reflects the change in the price of a security in relation to the movement in the market price. The expected return for Security A as per the security market line equation is as per below. Expected return = (p1 * r1) + (p2 * r2) + ………… + (pn * rn), where, pi = Probability of each return and ri = Rate of return with probability. Now let’s understand the security market line example, calculating the expected return Calculating The Expected Return The Expected Return formula is determined by applying all the Investments portfolio weights with their respective returns and doing the total of results. Consider two securities, one with a beta coefficient of 0.5 and other with the beta coefficient of 1.5 with respect to the market index.

Let the risk-free rate by 5%, and the expected market return is 14%.

Higher the market risk premium steeper the slope and vice-versa

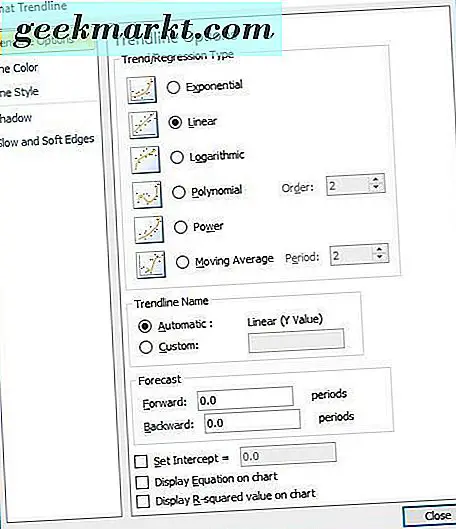

#Lineare regression excel formel how to#

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked The above equation can be graphically represented as below: E(R M) – R f is known as Market Risk Premium.E(R M) is expected to return on market portfolio M.We will discuss this in detail in this article. β i is a non-diversifiable or systematic risk.R f is the risk-free rate and represents the y-intercept of the SML.E(R i) is the expected return on the security.

0 kommentar(er)

0 kommentar(er)